- Friday 12 January 2024

KEY TAKEAWAYS

- After significant losses in 2022, stocks soared and bonds rebounded last year.

- Gains in the tech sector helped growth stocks outperform value stocks in the US, but the value premium was positive outside the US.

- Economic resilience in the US and elsewhere is helping boost the global outlook, but 2023 showed why planning for uncertainty is prudent.

It was a year that defied expectations by many accounts. A number of forecasts predicted that the US economy would enter a recession in 2023 as the Federal Reserve raised interest rates to fight high inflation. But the economy remained resilient, inflation eased, and the Fed declined to lift rates later in the year. US stocks rose in 2023, despite some setbacks along the way.1 Many economists who called for a recession have since walked back their predictions. This underscored that guessing where markets may be headed is not a reliable way to invest.

EQUITIES

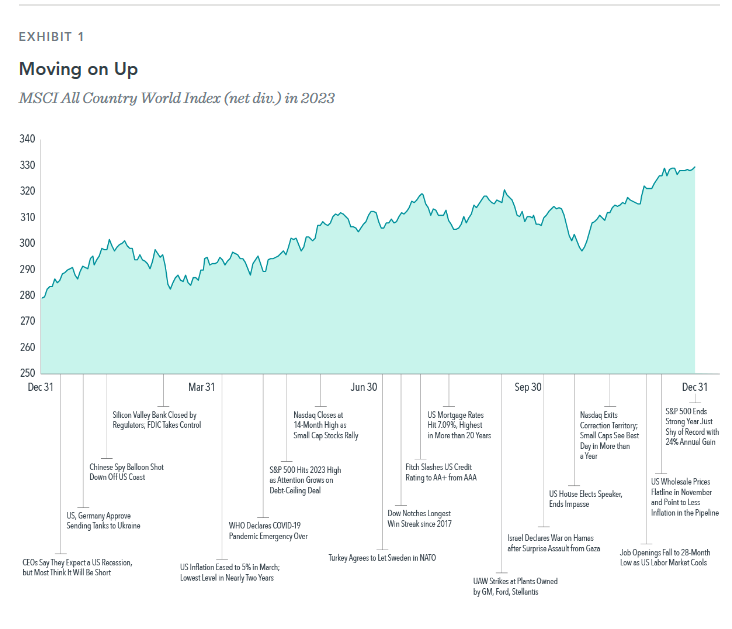

A year that many speculated would be lackluster for stocks saw the S&P 500 post gains of 22.0% on a total-return basis, extending a bull-market rally that began in 2022.2 Global stock markets also bounced back after posting their worst year since the financial crisis. Equities, as measured by the MSCI All Country World Index, rose 18.1% even as geopolitical tensions increased, with war continuing in Ukraine and hostilities erupting in the Middle East (see Exhibit 1).3 Outside the US, developed stocks (represented by the MSCI World ex USA Index) added 13.9%, with the MSCI Europe returning 15.8%. Emerging markets notched smaller gains, with the MSCI Emerging Markets Index up only 6.1%.

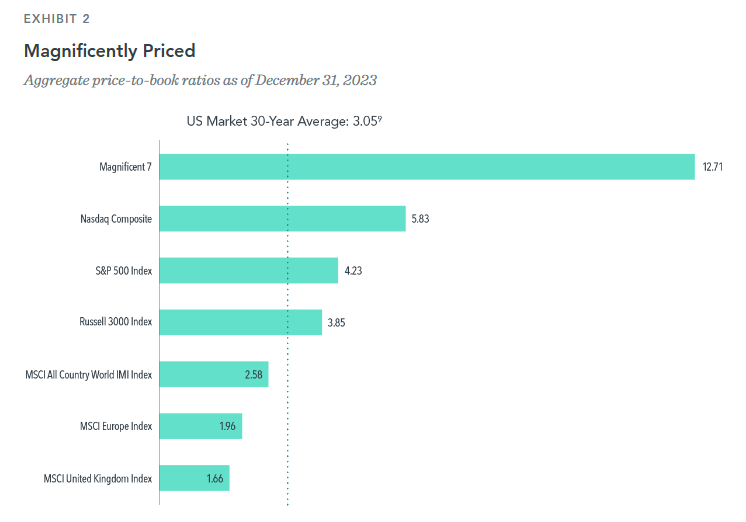

Among the strongest performers in 2023 were technology stocks, recovering after a poor showing in 2022. The tech-heavy Nasdaq rose 39.7%.9 Much of the stock market’s gains can be attributed to just a handful of companies, recently dubbed the Magnificent 7.10 They were led by NVIDIA amid strong sales of its computer chips, as interest in artificial intelligence built. However, valuations for those seven stocks remain high, with an aggregate price-to-book (P/B) ratio of 12.71. This helped push up the Nasdaq’s P/B ratio to 5.83. Some other prominent indices have substantially lower valuations. For example, the MSCI All Country World IMI Index’s P/B ratio is less than half that of the Nasdaq’s (see Exhibit 2), with UK and Europe having P/B below 2.00. While high valuations may concern equity investors, they can result from a subset of companies. Investors should be careful not to paint all stocks with the same brush.

Magnificent 7 outperformance might be difficult to sustain; past gains don’t guarantee future ones. Rather than seeking additional exposure to these mega cap stocks, investors may be better off ensuring their portfolios are broadly diversified, positioned to capture the returns of whatever companies may rise to the top in the future. This is particularly relevant if you work in those companies or associated industry, as discussed in our ‘insight'.

Unsurprisingly, smaller companies lagged behind large cap stocks globally: The MSCI All Country World Small Cap Index returned 12.9% vs. 18.1% for the larger-cap MSCI All Country World Index. Nevertheless, small caps and value stocks have historically outperformed large caps and growth stocks, and we will continue to keep them in our portfolios as a method of diversification.

BONDS

In the bond market, government bonds rebounded after posting their worst annual return in decades in 2022, with the US 10-year Treasury Bond Index gaining 4.1% vs. the previous year’s -12.5%, and the Bloomberg Euro Aggregate Government Bond Index returning 7.1%, compared with -18.2% in 2022. But it was not a smooth ride for investors. Despite rising bond prices generally, yields (which fall when prices rise) were higher than they have been for most of the past decade. Yields touched 5% in October for the first time since 2007, before pulling back below 4% by year-end. While many investors see yield curve inversion as a foreboding signal of a recession or stock market downturn, data from the US and other major economies show yield curve inversions have not historically predicted stock downturns consistently.

JAPAN - THE BRIGHT SPOT

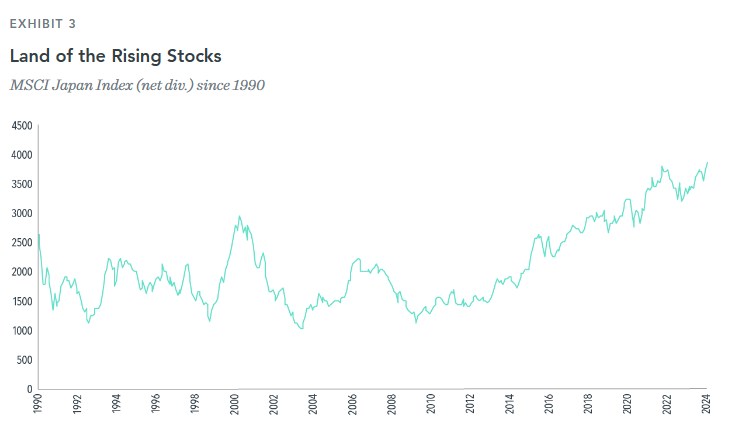

After decades of lagging behind, Japan has lately been a bright spot in global markets. From 1990 to 2022, Japan saw its share of the global market cap decline from 40% to 6%! But since the end of September 2022, Japan has posted an annualised return of 16.3%, with stocks there nearing an all-time high.

The turnaround in Japan is more evidence that regional and country returns will vary from year to year. An up year for US or Japanese stocks might be followed by a down year, showing the benefits of remaining globally diversified. The randomness of global stock returns makes it difficult to figure out which markets are likely to be outperformers. In the past 20 years, annual returns in 22 developed markets varied widely from year to year.

Holding equities from markets around the world—as opposed to those of a few countries or just one—positions investors to potentially capture higher returns where they appear, and outperformance in one market can help offset lower returns elsewhere.

WHAT'S IN STORE FOR 2024?

Economic resilience in the US and elsewhere is helping boost the global outlook for 2024, but as investors learned last year, the only thing certain is that there will be plenty of uncertainties. Many variables are in play for markets this year, from wars in Ukraine and the Middle East to questions around interest rates. Investors are also likely to be closely following the upcoming presidential election in the US. But it’s worth noting that the political party that wins the White House is just one of many factors investors consider when pricing assets, and stocks have generally trended upward regardless of which party holds the presidency. This may be reassuring when one considers the difficulty, or perhaps futility, of trying to guess what is going to happen in 2024—or any year.

If you have any questions regarding your investment strategy, feel free to reach out and ask!