- Tuesday 07 September 2021

This Year so Far

2021 has been a year of ‘ongoing recovery’ for individuals, society & economies. As is often the case, markets are further along the ‘sentiment’ curve so this expected recovery has delivered strong double-digit growth in most equity funds (and flat performance in more conservative assets like Bonds), generating mostly excellent returns for investors who have stayed the course.

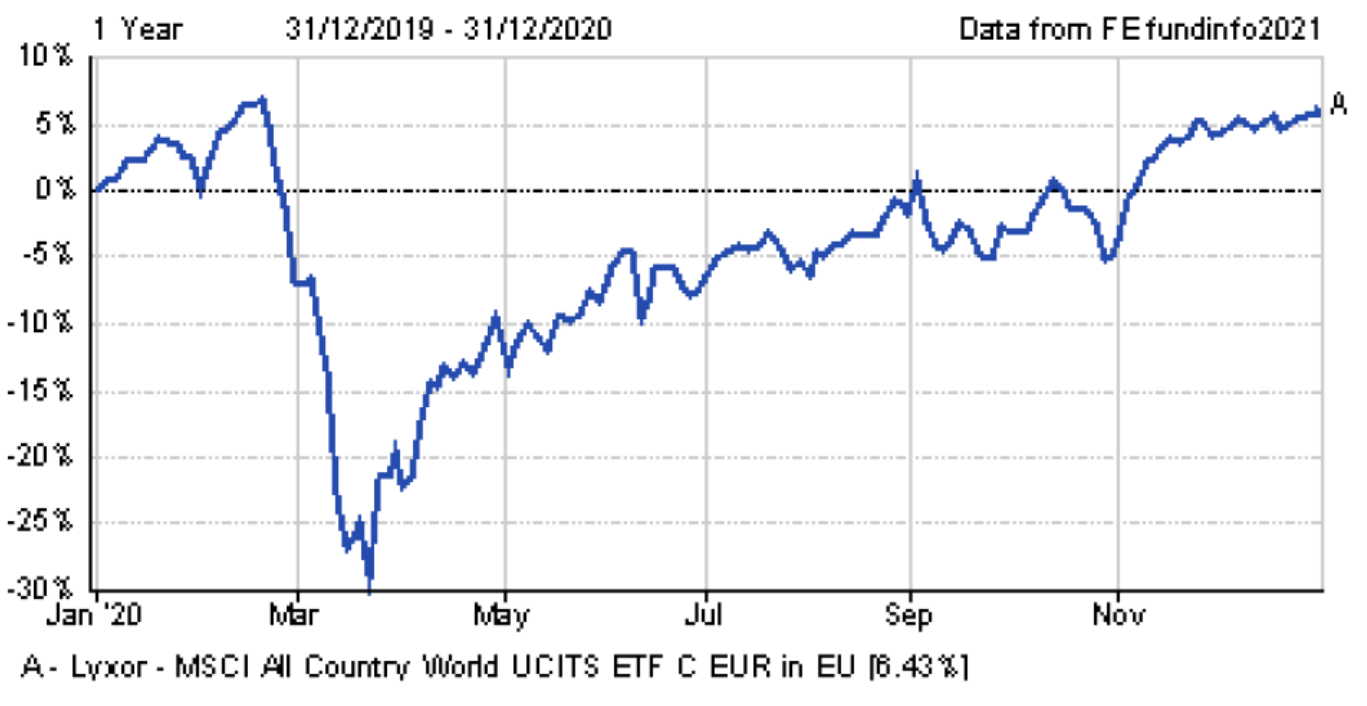

The MSCI All-World index is the most commonly used global investment benchmark and takes a weighted aggregate view of all individual country performances. In 2020, the All-World return was an incredible 6.4%. While it mightn’t seem exceptional, it included a 3 week ‘correction’ or fall in values in March of nearly -35%, so to have had a positive return for the year at all was a pleasant surprise.

In 2021, the Year to Date performance of the MSCI Index has been 20.44% and you can see the chart showing this below. What is noticeable is that, while there have been a number of dips, where markets fell over 2% in a week, for the most part they were immediately followed by a recovery and continuing upward trajectory.

.png)

A MORE DETAILED PICTURE:

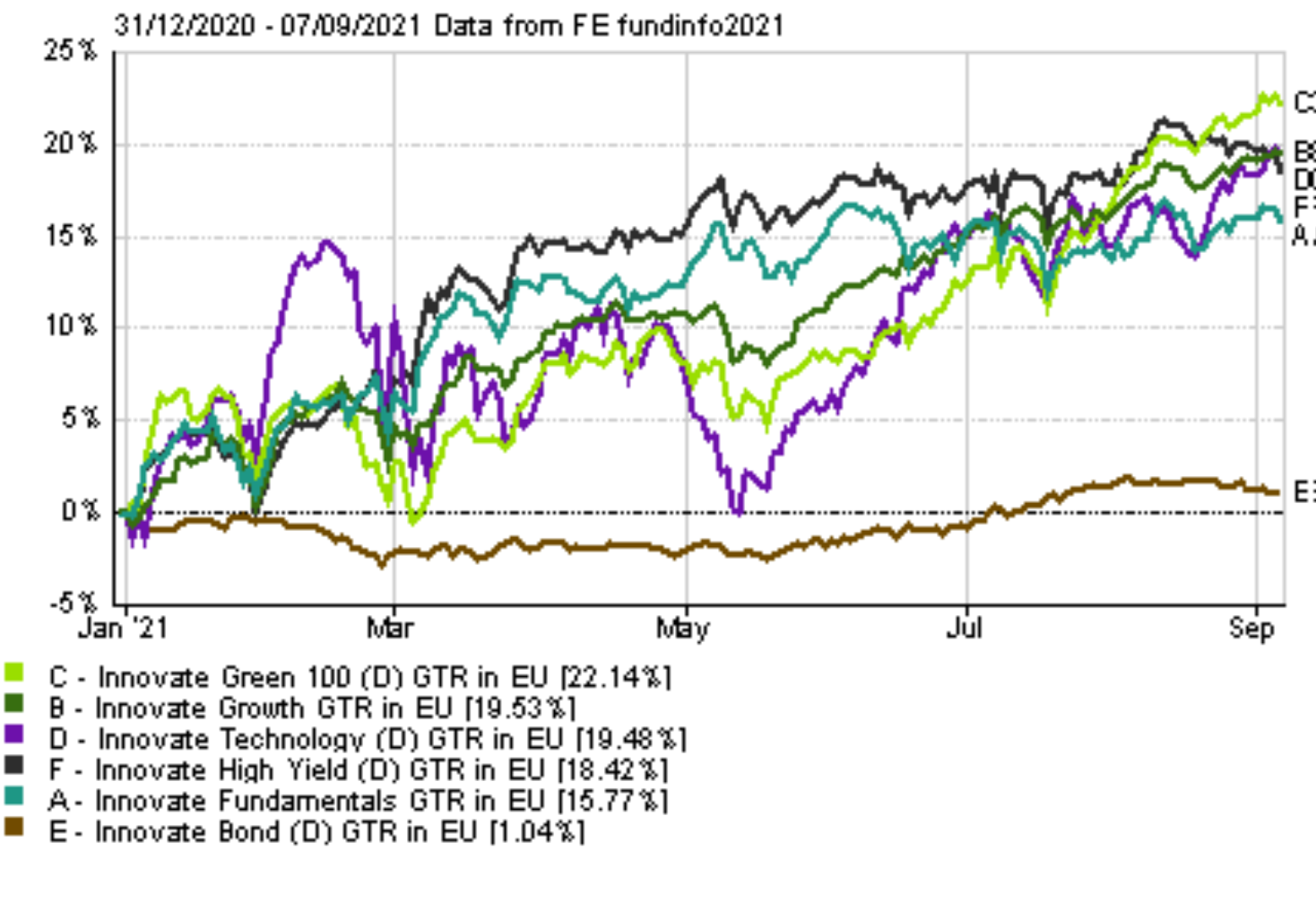

Our version of the All-World Index is called the ‘Innovate Growth Portfolio’ and it has delivered comparable returns of 19.5% in 2021. This portfolio contains a number of underlying funds, mostly associated with different geographic indexes, but also including some additional sectors for diversification. As such, it is useful to see how each fund is performing individually.

.png)

You can see that there is a significant range of returns across the underlying funds, from over 25% for our Global Property REIT and S&P 500 to just under 9% for Emerging Markets.

WHAT NEXT?

The general consensus among market analysts, ourselves included, is that the global market outlook is still positive at this point. Notwithstanding the new, more contagious COVID variants, global economic reopening should continue across major developed countries through the final quarter of 2021 and into 2022. As a result, the focus for fund managers and investors has shifted to looking at the potential strength of this growth rebound, while acknowledging the implications for inflation and the connected timing of central bank moves to temper prices and even potentially raise interest rates.

Our view is that any inflation spike would be mostly transitory, a combination of recovery of the Consumer Price Index (CPI), which fell during the COVID lockdown last year and (hopefully) temporary supply issues. However, it is expected to take until the middle of 2022 for the U.S. economy to recover the lost output from lockdown and longer in other economies such as Europe and Emerging Markets. As a result, significant inflation pressures are unlikely until then. It also means that market expectations for global central bank activity, such as ECB interest rate rises, are for the end of next year or into 2023.

There is no doubt that global equities are expensive however, especially in the US, though value does exist elsewhere – especially in Europe. Most analysts like ourselves continue to hold a preference for equities over bonds for at least the next 12 months, despite these more expensive valuations.

For investors like you, putting your money to ‘work’ in markets is a much more nuanced experience. Because our recommendations are based on your real life financial goals – as well as incorporating time and risk attitude – your Asset Allocation, the % of your money assigned to the two main assets of Bonds and Equities, is a key consideration. As such, we are still comfortable with the allocation of bonds in our portfolios, as a hedge to equity volatility and also as an ‘opportunity’ reserve in case of a short/sharp market correction.

Current market outlook also reinforces our choice to include other Factors of Investment Return, primarily of Value & Small-Cap equity to avoid too much exposure in large-cap growth stocks, especially the big technology companies. Our decision to maintain ‘pre-2020’ exposure for non-U.S. equities is also intended to reduce the downside risk in our Global Equity (Innovate Growth) Strategy.

Finally, the thematic strategies of Green/ESG alongside Technology and Commodity/Infrastructure allow our clients to access companies and funds that have their own journey, though within the same volatility/growth framework as broad global equity funds.

BENCHMARKING OUR PORTFOLIOS | THE INNOVATE RANGE

- EXTERNAL BENCHMARKING

We understand that when most of our Investor Clients are thinking about bringing their money into our Curran Futures Innovate Model Portfolios, you have the choice of any number of other providers and funds. These are our local competitors and we are determined to deliver outperformance on an ongoing basis against them.

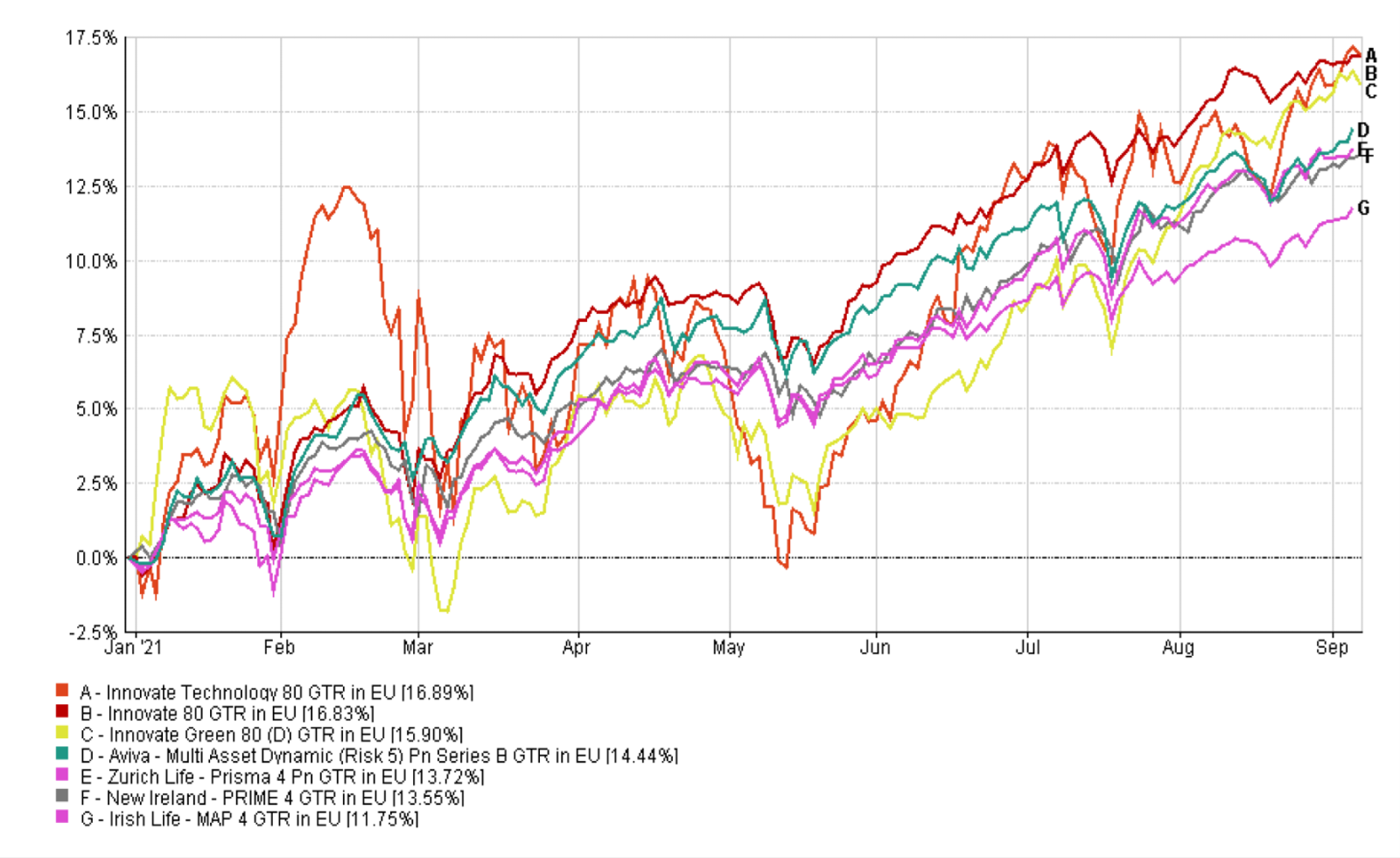

In order to provide a true comparison, we must compare equivalent strategies. As the most popular funds in the Irish Market tend to be those with an ESME 4 Rating (i.e. mid/high volatility & returns expectation), we use our Innovate 80 range as the benchmark, because the Asset Allocation is most similar. In the below graph you can see the comparative YTD performance of our ESME 4 Portfolios (Green, Growth (Global Equity) and Technology).

For full transparency, we would note that while our Equity/Bond holding in this fund range is a fixed 80/20 ratio, our competitors will actively change their holdings throughout the year based on their assumptions about future market performance. Their current (equity/bond) holdings are:

- Zurich – Prisma 4: (70/30)

- New Ireland – Prime 4: (82.10/17.90)

- Irish Life – Map 4: (84.50/15.50)

- Aviva – Multi Asset Dynamic: (84.13/15.87)

- INTERNAL BENCHMARKING

Across our range of strategies, we are satisfied that our various Innovative Portfolios have shown risk & market appropriate performance for 2021. Our best performing strategy YTD is our Innovate Green Portfolio, showing that a proactive ESG approach can continue to deliver market leading returns. We also believe that with the Green Agenda firmly to the forefront of government and industry minds, it will continue to deliver its targeted returns.

Our other portfolios are close behind however and with many of our investor clients choosing to diversify their pension and savings across multiple strategies, we believe we are facilitating a truly innovative approach

FINALLY: MEDIA FOCUS ON PENSION & INVESTMENT FUND CHARGES

One of the biggest frustrations of advisors and investment managers who try to provide clear and transparent fee information around their funds and strategies is the fact that the financial industry in Ireland can still hide behind some well-worn methods to keep this information from you. This makes it next to impossible to properly compare the costs of investing in, for example, our Innovate Range versus any of the funds referenced above.

We’re delighted to say that in recent times this issue has been put under the spotlight more and over the last few months there have been some excellent articles written, most notably in the online publication The Currency. In these pieces, which are behind a paywall but very much worth the investment in our view, they explore and pick apart the whole area of charges around pensions and investments. A good starting article can be found HERE