- Thursday 14 March 2024

As Irish Banks continue to drag their heels in passing on the ECB interest rates to savers, a new range of offerings are being presented to Irish Consumers. But are they what they seem?

“Revolut Challenges Irish High-Street Banks with new Savings Account’ (Sunday Business Post)

“Wise offers interest rate above 4% for instant access account” (FF News)

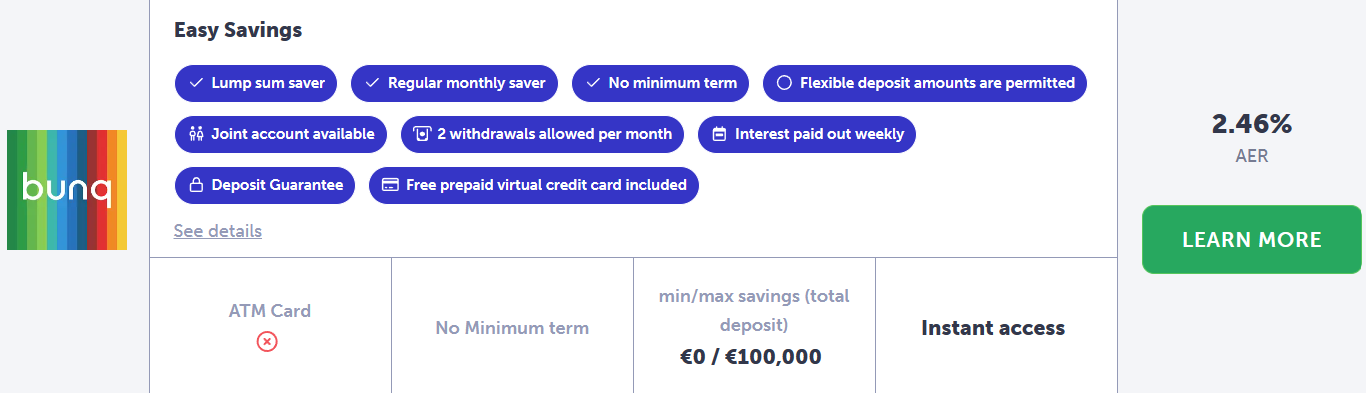

“Bunq puts it up to Irish Banks with with instant access saving rate of 2.46%” (Irish Times)

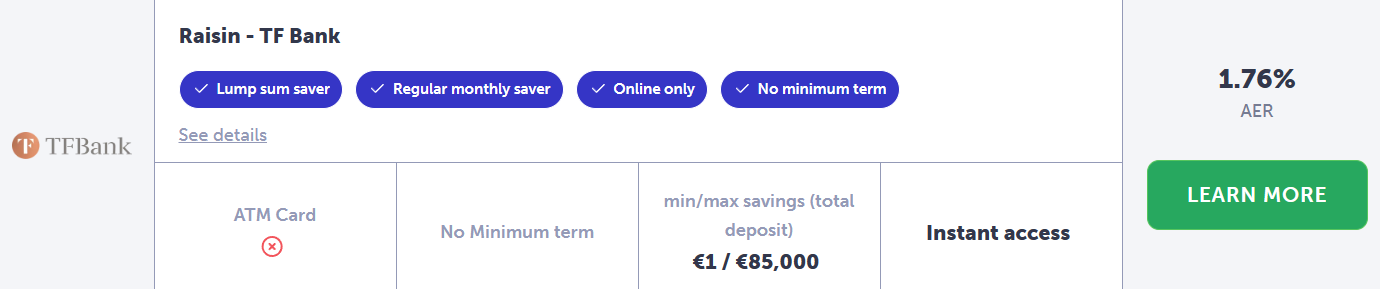

“Raisin eyes up a bigger stake in Irish savings Market” (Irish Independent)

The famous quote from Aristotle that ‘nature abhors a vacuum’ is often used in the business world when incumbent companies fail to keep pace with the market. This is particularly true at the moment as, for whatever reason, the savings offerings of the major retail banks in Ireland continue to disappoint.

Into their wake, an increasing number of new providers – often called neo-banks, platforms or fintechs – have stepped in to offer what seems to be a much better deal for their customers money.

Over recent months we have worked with a large number of clients who have asked for cash alternatives that will generate better returns than the banks and, as a result, have built up a good understanding of how these accounts operate.

The first thing to say is that not all providers operate the same. Some are smartly using EU legislation to allow Irish savers access ‘foreign’ deposit accounts, while others are using a slightly different mechanism. Let’s break them down here.

What are the offers?

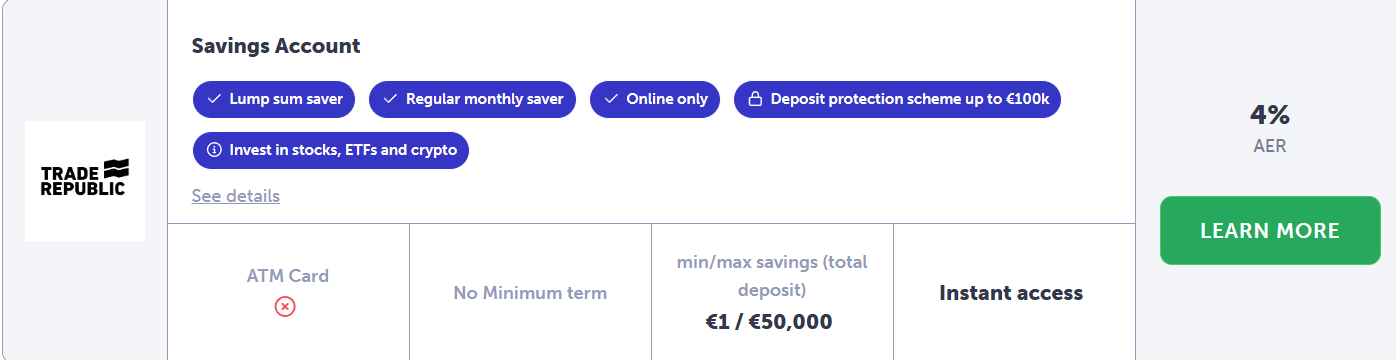

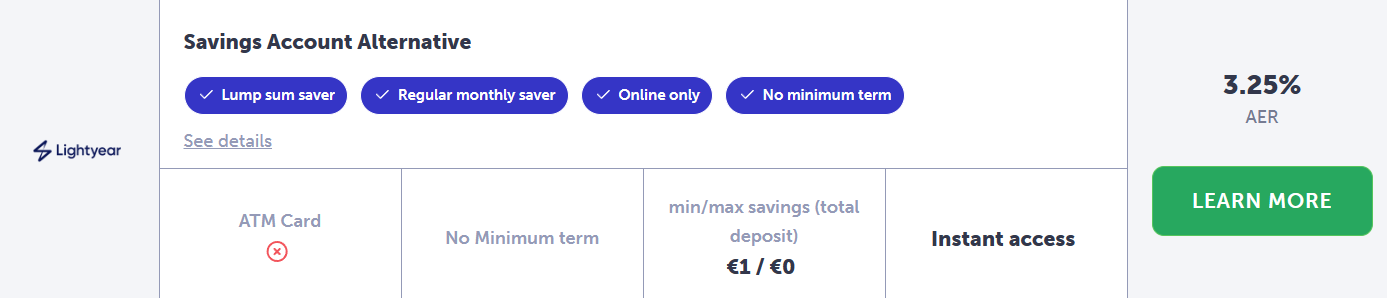

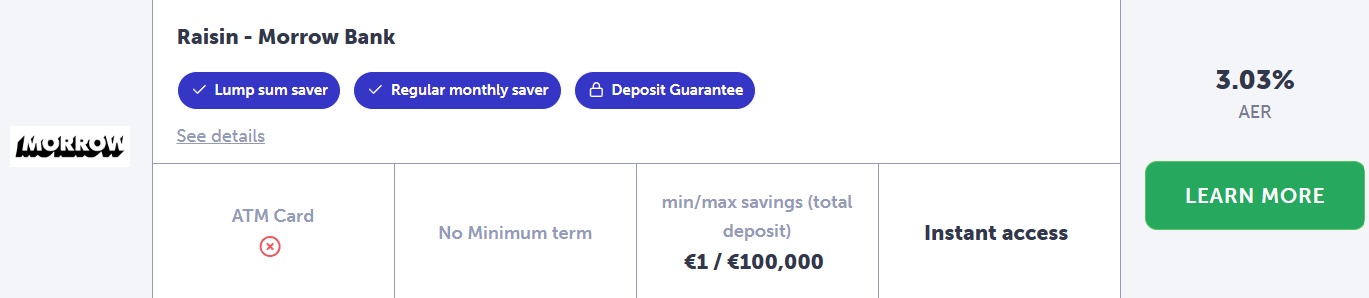

We are a huge fan of www.bonkers.ie for getting up to date information on deposit and lending rates on the Irish Market. The change in the savings environment over the last few months is noticeable, as you can see here:

(Note: Revolut are not included in the Bonkers search engine for the moment)

These are the top 5 rated options presented, with the Irish banks someway behind in terms of AER.

If you choose one of these options, your money will be invested in a number of ways, each of which require some research and understanding.

Money Market Funds

Revolut, Bunq and Lightyear each use an investment structure known as a Money Market Fund (MMF). This is best described as an ‘aggregate’ deposit holding, where a fund manager (not always easily identified) will invest client funds across multiple – often dozens or even hundreds – of global banks.

MMF’s don’t offer a fixed rate per se, but generally have – at least over the short term – a reasonably accurate estimate of their variable interest payable. Funds are usually accessible on demand. We would generally place a Money Market Fund at the very lowest risk level, so they are (assuming the fund manager is reputable) considered relatively safe.

Some things to note are the lower Central Bank protections for these funds compared to true deposit accounts (Revolut’s fund is capped at €22k), potentially higher tax on returns at 41% exit tax rather than DIRT of 30% and the necessity to submit these returns yourself to revenue through your tax return.

Foreign Deposit Accounts

Raisin specialises in offering Irish consumers bank deposit rates from around the EU and beyond. It is slightly depressing that institutions in France, Portugal and Italy can offer rates five times or more better than Irish offerings, but that is the reality. Because they are actual bank deposits (rather than MMFs) the protection scheme set by countries in the EU is €100k, so substantially higher, though the credit rating of the bank itself is probably worth noting.

The offerings for fixed term accounts are especially good, but your money here is locked away for the term and cannot be accessed. As with the MMFs, you will likely have to submit your own tax returns for the interest generated and the rate you pay can be dependent on your personal circumstances. Finally, some countries withhold part of the DIRT at source, which you must take note of.

Our View

There is no doubt that both Money Market Funds and foreign fixed deposit accounts can have a place in an investors portfolio. However it is really important to understand their workings, benefits and drawbacks before proceeding. This is particularly the case with accounts that can be accessed with such ease through many of the newer platforms.

If you are looking for a better cash rate or deposit alternative, call us for some guidance on the most suitable option for you.

Disclaimer

All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice.